Best Accounting & Audit Firm | Start-up & Emerging Funds

Akram is a winner in the Hedgeweek Americas Awards for consecutive 3 years 2021, 2022, and 2023

"We have been voted “Best Accounting Firm for Start-up & Emerging Funds by Hedge Week”.

Akram is a winner of “Best Audit Firm" by Private Equity Wire US Emerging Managers Awards 2024.

.png)

Accounting Services for Alternative Investment Clients

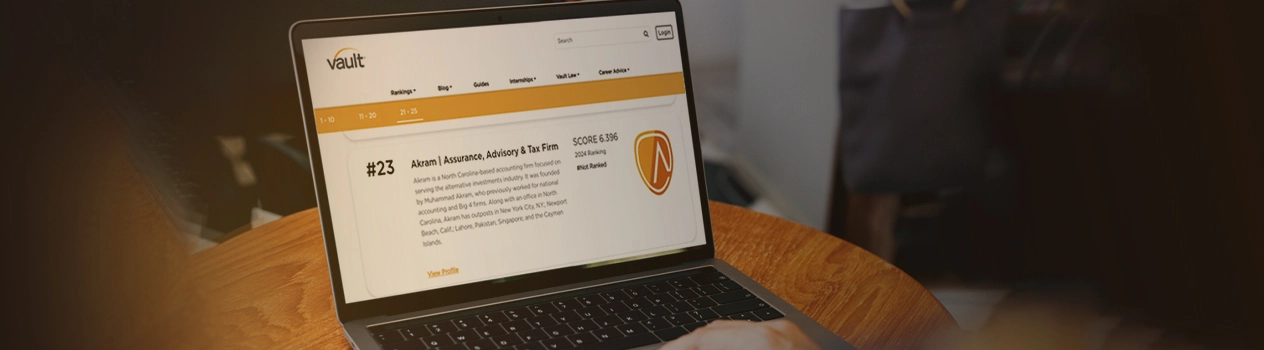

Akram | Assurance, Advisory & Tax Firm is a boutique CPA Firm

with offices in the US and abroad. We are a full-service accounting

firm providing assurance, advisory, and tax services for the

financially savvy, especially hedge funds, cryptocurrency funds,

investors, traders, family offices and high net worth individuals.

At Akram Assurance, Advisory & Tax, we excel at accounting services for Fund Managers.

Turn-key solutions that enable investment managers to create tax-compliant IDFs.

Turn-key solutions that enable investment managers to invest in Private Equity Fund.

Akram has a robust practice focused on serving family offices ranging from SFOs to MFOs.

Non-profits are under great scrutiny and require transparency and accountability more than ever.

Akram helps privately held companies improve their bottom line by increasing accounting efficiency.

What Clients Say About Akram

Muhammad and his team are remarkable. Very efficient, competitively priced, and most importantly, an ongoing advisor to me as I build my company. Their knowledge of best practices for emerging investment managers is extensive, and I completely endorse their services.

Robert Cantwell - Founder at Upholdings Group, LLC - San Francisco, CA

They are very detail oriented and worked relentlessly to help our firm with the needs of our funds... helped us with K-1s and corporate tax projects, always looking to find ways to maximize our project goals and targets.

Viet Ly - Principal Management, LLC - Seattle, WA

I highly recommend Akram & Associates for tax and audit accounting in the financial services sector. Muhammad and his team are top tier professionals and exceeded our expectations.

Dante Federighi - Founder at Fortezza Forza RMC Fund, LLC - Chicago, IL

Akram & Associates has been very client-focused during my tenure with Firm. They have been very receptive to my unique requirements and have been very knowledgeable and proactive to industry best practices.

Monish Bahl - MHB Capital - Atlanta, Georgia

The team has consistently outperformed our high expectations of them and we could not be more pleased with the service provided. It is clear that Muhammad takes great pride in his work and is available at all hours of the day to ensure that his clients receive highly personalized service.

Jeff Shon,REDDS VIP - Irvine, CA

Akram & Associates is without a doubt, one of the most reliable, dedicated, and professional companies we have ever had the privilege to work with. Mr. Akram is incredibly knowledgeable in his field and we've never come to him with a problem and left without a solution.

Raquelle & Brian Elkins, Greene Energy Companies- Cary, NC

I've been working with Muhammad for two years and he is the best accountant I've ever worked with. He's reliable, on time, and has answers to just about any question you might have for him.

Cooper Waterman - Waterman Entertainment - Los Angeles, CA

I have been working with Akram and Associates for several years now and have shifted virtually all of my services to the firm (tax, accounting, audit work, etc). They offer extremely competitive rates, reasonable turnaround time, and high response rates. I will continue to provide business and build my relationship with the founder. I strongly recommend for emerging fund managers and family-office backed funds.

Anthony Georgiades - Innovating Capital Management, LLC- NYC

During the process of working with Akram & Associates, I worked with Muhammad and his staff directly on getting audited returns. Muhammad showed great knowledge and expertise in dealing with hedge funds and was able to provide great service and feedback through out the entire process. Muhammad was great attribute to our business in 2019 and highly recommend him to other funds. We will continue to use Akram & Associates moving forward.

AJ Di Cioccio - i3 Investment Partners, LLC - Orange County, California

Top-notch services from a true professional firm. Happy to be a client!

Jeff Miller - Eight Bridges - Portland, Oregon

Contact Us for Investment Fund Accounting Solutions

We understand that clients in the Alternative Investments arena are extremely prudent. At Akram, we provide high-end, tailored fund accounting services with careful planning and an unmatched responsiveness that only a boutique accounting firm like ours can deliver. Contact us today to learn more about our specialized assurance, advisory, and tax services for hedge funds, commodity trading advisors, private equity and venture capital funds, digital asset funds, insurance dedicated funds, real estate funds, day traders, investors, family offices, and high net worth individuals.

.webp)