New Audit Requirement 2023 for Private Fund Advisors by SEC

New Audit Requirement 2023 for Private Fund Advisors by SEC

On August 23, 2023, the U.S. Securities and Exchange Commission (“SEC”) implemented heavily anticipated private fund reforms (the “Private Funds Rules” or the “Rules”) promulgated under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

Although the Rules are far less “mandate-driven” than those originally proposed in February 2022, the Rules nevertheless impose significant disclosure (and in some cases, operational) requirements that all private fund advisers (“Fund Managers” or “Managers”) should consider when forming new funds or similar pools of assets (each, a “Fund” and collectively “Funds”) or operating existing Funds.

Broadly, the SEC has passed two rules applicable to all Managers of private pooled investment vehicles, regardless of the registration status of the Manager, prohibiting four types of “preferential treatment” of one or more individual investors and five types of “restricted activities” unless certain disclosure, investor consent, or operational exceptions are met, depending on the type of preferential treatment or restricted activity.

Furthermore, SEC has also passed four rules applicable only to SEC-Registered Investment Advisers to private funds and their related persons (collectively, “SEC RIAs”) requiring periodic disclosure of certain information and reports to Investors and certain actions to be undertaken, including:

(1) an annual audit requirement of all Funds managed by the SEC RIAs; and

(2) quarterly reporting of Fund-level (x) performance metrics and (y) itemized fees and expenses.

Also, we have provided a list of concrete “Bottom-Line Takeaways” under Section III hereof which all Managers should consider in light of the new Rules.

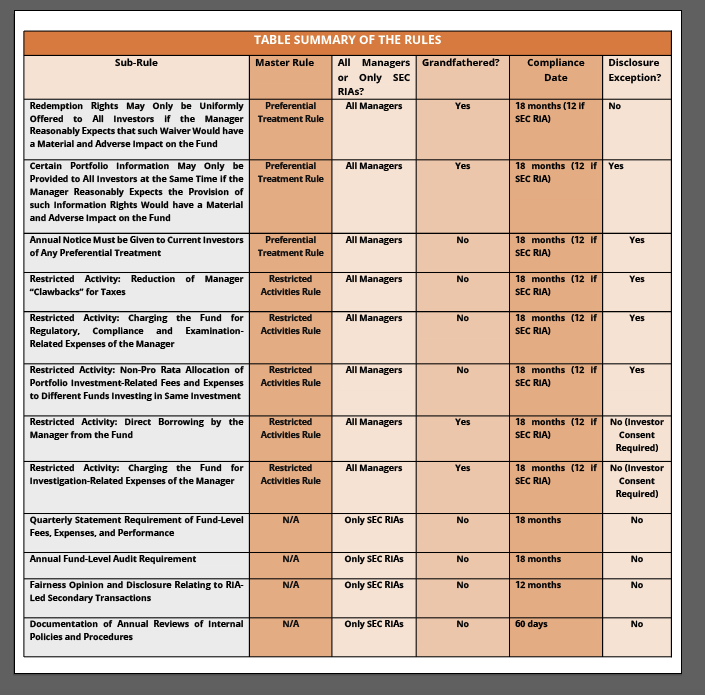

Lastly, for quick reference, a “Table Summary” of the Rules is provided in table form under Exhibit A.

I. Two Rules Applicable to All Fund Managers, Regardless of Registration Status

The Rules contain two rules, broadly defined, which are applicable to all Managers, regardless of Manager registration status under the Advisers Act or any other U.S. federal or state governmental or regulatory authority (each, a “Governmental Authority”):

(1) the Preferential Treatment Rule; and

(2) the Restricted Activities Rule.

1. Preferential Treatment Rule

The Preferential Treatment Rule addresses four types of preferential treatment potentially awarded by Managers to investors (“Investors”) in the Funds the Managers manage.

Disclosure of one of these types of preferential treatment (“Redemption Rights May Only be Uniformly Offered to All Investors”), by itself, does not make such activity permissible in any case.

However, certain disclosures of the other three types of preferential treatment may by themselves make such treatment permissible.

a. Preferential Treatment Without Disclosure Exceptions

(i) Redemption Rights May Only be Uniformly Offered to All Investors

Managers are prohibited from granting redemption rights that the Manager “reasonably expects” will have a “material and adverse” effect on other Investors in a Fund unless:

(i) the Manager has offered and will continue to offer such redemption rights to all existing and future Investors; or

(ii) the Investor, as assessed on a case-by-case basis, is bound by laws, rules or regulations that mandate a certain redemption right.

The SEC has not given significant guidance on what specifically constitutes a “redemption right,” we would expect that common fund terms such as lock-ups, gates, notice period for withdrawals or early withdrawal penalties would generally constitute a redemption right that if waived or reduced would need to be extended to all Investors if the fund manager expects such extension would have a “material and adverse” impact on the Fund. Nor has the SEC enumerated what is likely to constitute “material” and “adverse” impact on the fund in connection with the grant of preferred liquidity term. As such, if there is a plausible argument that the grant of a preferred liquidity term could negatively impact a fund, even remotely, we would recommend that such preferred liquidity term be extended to all investors.

. Note: This is a Grandfathered Rule, as defined below.

b. Preferential Treatment with Disclosure Exceptions

(i) Certain Portfolio Information May Only be Provided to All Investors at the Same Time

If a Manager reasonably expects that providing certain information about the portfolio holdings or exposures of a certain Fund would have a material and negative effect on other Investors, Managers may only provide such information to one or more Investors if the Manager provides such information to all Investors at the same or substantially the same time. Note: This is a Grandfathered Rule.

(ii) Notice Must be Given to Prospective Investors of Current Preferential Treatment as to Material Economic Terms

Managers must provide notice to prospective Investors regarding (i) whether the Managers are currently giving preferential treatment relating to “material economic terms” of the Fund and (ii) if so, a “specific description” of the material terms of such treatment, including the applicable fee rate or dollar amount of the specific compensation, as applicable. Such terms may, without limitation, relate to (i) liquidity and redemption rights, (ii) management fees, (iii) performance fees, (iv) placement agent compensation, (vi) investment costs, (vii) co-investment rights and (viii) certain other expenses and fees directly charged to Investors. Note: This is not a Grandfathered Rule.

(iii) Annual Notice Must be Given to Current Investors of Any Preferential Treatment

Managers must “describe specifically” to current Investors any preferential treatment, regardless of materiality, granted to one or more Investors. Such description must be given as soon as is reasonably practicable to Investors in:

(i) illiquid Funds following the end of the Fund’s fundraising period; and

(ii) liquid Funds following an Investor’s investment in the Fund.

As discussed above, disclosing the mere fact that such preferential treatment has been granted is insufficient for compliance. The Manager must “describe specifically” the preferential treatment, including the applicable rate for any different fees assessed or the specific dollar amount of any differing compensation.

Additionally, a Manager must release, on at least an annual basis, such description to all current investors of any additional or different preferential treatment since the last such description provided (if any). Note: This is not a Grandfathered Rule.

2. Restricted Activities Rule

The Restricted Activities Rule addresses five specific activities of Managers.

Making certain disclosures, by themselves, will enable three of such activities to be undertaken by Managers:

(i) Reduction of Manager “Clawbacks” for Taxes;

(ii) Charging the Fund for Regulatory, Compliance and Examination-Related Expenses of the Manager; and

(iii) Non-Pro Rata Allocation of Portfolio Investment-Related Fees and Expenses Across Different Funds Investing in Same Investment

However, to engage in two of such activities, Managers, in addition to making certain disclosures, will be required to obtain written “investor consent” to such activities in advance (“Investor Consent”):

(i) Direct Borrowing by the Manager from the Fund; and

(ii) Charging the Fund for Investigation-Related Expenses of the Manager

The threshold for Investor Consent, for purposes of the Rules, refers to a majority-in-interest of the Investors that are not related persons of the Manager.

a. Three Restricted Activities with Disclosure-Based Exceptions

(i) Reduction of Manager “Clawbacks” for Taxes

If the Manager decides to authorize any “clawbacks” in the Fund’s offering documents (a provision whereby the Manager will be obligated to pay back any previously received performance fees to the Investors upon certain events delineated in the Fund’s Governing Documents), the Manager may not reduce the clawback by any actual, potential, or hypothetical tax amount unless the Manager discloses the pre-tax and post-tax clawback amount to all investors within 45 days of the end of the fiscal quarter in which such clawback occurs. Note: This is not a Grandfathered Rule.

(ii) Charging the Fund for Regulatory, Compliance and Examination-Related Expenses of the Manager

The Manager must disclose within 45 days of the end of each fiscal quarter after directly charging Investors the following fees and expenses:

(i) regulatory or compliance fees and expenses associated with the Manager or its related persons; and

(ii) fees and expenses associated with an examination of the Manager or its related persons by a Governmental Authority.

Note: This is not a Grandfathered Rule.

(iii) Non-Pro Rata Allocation of Portfolio Investment-Related Fees and Expenses Across Different Funds Investing in Same Investment

If the Manager elects to allocate fees and expenses associated with a portfolio investment (each, a “Portfolio Investment” and collectively, “Portfolio Investments”) on a non-pro rata basis across different Funds investing in the same Portfolio Investment(s), the Manager must disclose, in advance:

(i) such election; and

(ii) an explanation as why such allocation is fair and equitable.

Note: This is not a Grandfathered Rule.

b. Two Restricted Activities with Investor Consent-Based Exceptions

(i) Direct Borrowing by the Manager from the Fund

The Manager must both disclose and receive Investor Consent for any borrowing from the Fund. Note: This is a Grandfathered Rule.

(ii) Charging the Fund for Investigation-Related Expenses of the Manager

The Manager must both disclose and receive Investor Consent for authorizing charging the Fund for fees and expenses related to investigations of the Manager or its related persons by a Governmental Authority.

The Manager is absolutely prohibited from charging the Fund for fees and expenses related to any such investigations resulting in sanctions imposed by a court or Governmental Authority for a violation of the Advisers Act or the rules promulgated thereunder. Note: This is a Grandfathered Rule.

Note on “Compliance Dates”

Managers that are:

(i) “large private fund advisers,” defined as Managers with at least $1.5 billion in Fund assets under management (“AUM”), have a compliance date of:

(A) 18 months after final publication of the Rules in the federal register for the (x) “Quarterly Statement Requirement of Fund-Level Fees, Expenses, and Performance” and (y) “Annual Fund-Level Audit Requirement” portions of the Rules; and

(B) 12 months after such publication for all other Rules; and

(ii) “small private fund advisers,” defined as Managers with less than $1.5 billion in Fund AUM, have a compliance date of 18 months after such publication (each such date, a “Compliance Date”).

Note on “Grandfathered Rules”

There are certain portions of the Rules (the “Grandfathered Rules”) that do not apply to Funds if:

(i) a Fund has commenced operations (broadly defined by the SEC as having engaged in bona fide investment, fundraising, or operational activity) as of the Compliance Date;

(ii) the Governing Agreements of the Fund were entered into prior to the Compliance Date; and

(iii) if the Governing Agreements were found to be subject to the applicable portion of the Rules, such parties would be required to amend the Governing Agreements.

These Grandfathered Rules are:

(i) Under the Preferential Treatment Rule:

(A) “Redemption Rights May Only be Uniformly Offered to All Investors”;

(B) “Certain Portfolio Information May Only be Provided to All Investors at the Same Time”; and

(ii) Under the Restricted Activities Rule:

(A) “Direct Borrowing by the Manager from the Fund”; and

(B) “Charging the Fund for Investigation-Related Expenses of the Manager”.

These exceptions are also noted in the descriptions of each rule above.

Note on Recordkeeping

All managers, generally, will be required to maintain copies of any written notices, audited financial statements, periodic reports or similar information required to be disclosed or provided to Investors below.

II. Four Rules Only Applicable to SEC-Registered Managers and Related Persons (collectively, “SEC RIAs”)

1. Quarterly Statement Requirement of Fund-Level Fees, Expenses, and Performance

An SEC RIA must distribute to all Investors a quarterly statement including certain information regarding the below:

(i) a Fund-level report of b:

(A) compensation paid by the Fund to the SEC RIA;

(B) fees and expenses charged to the Fund (even if related to the Fund and not the SEC RIA); and

(C) offsets or rebates carried forward to subsequent quarterly periods to reduce future SEC RIA compensation;

(ii) If applicable, a Portfolio Investment-level report of all compensation, fees, and other amounts paid to the SEC RIA or related person by the Portfolio Investment attributable to the Fund’s interest in the Portfolio Investment; and

(iii) a report of Fund-level performance information that discloses either in regards to:

(A) liquid funds, performance based on net total return on an annual basis for the shorter of:

(x) 10 fiscal years, prior to the quarterly statement; or

(y) since the Fund’s inception; or

(B) illiquid funds:

(x) performance based on internal rates of return and multiples of invested capital since inception; and

(y) a statement of all Investor contributions and distributions.

Note: This is not a Grandfathered Rule.

2. Annual Fund-Level Audit Requirement

All SEC RIAs must:

(i) cause the Fund to undergo an annual audit conducted in accordance with SEC Rule 206(4)-2 promulgated under the Advisers Act (the “Custody Act”); and

(ii) deliver the Fund’s audited financial statements to all Investors within 120 days (180 days for funds of funds) of the end of the Fund’s fiscal year in accordance with the Custody Act.

Note: This is not a Grandfathered Rule.

3. Fairness Opinion and Disclosure Relating to SEC RIA-Led Secondary Transactions

When conducting an SEC RIA-led secondary transaction with respect to any Fund, the SEC RIA must disclose to all Investors prior to the due date of the Investor transaction election form:

(i) a fairness or valuation opinion from an independent valuation firm; and

(ii) for the 2-year period prior to the date on which the opinion was released, a report of the RIA’s material business relationships it currently has or has had with the valuation firm releasing such opinion.

Note: This is not a Grandfathered Rule.

4. Documentation of Annual Reviews of Internal Policies and Procedures

SEC RIAs must maintain written documentation, within 60 days of the filing of the Rules with the federal register, of annual reviews of their internal compliance policies and procedures, including a report on the effectiveness of such policies and procedures. Note: This is not a Grandfathered Rule.

Other Notes Related to SEC RIA Rules

No Applicability of SEC RIA Rules to Exempt-Reporting Advisers (ERAs)

The SEC has explicitly communicated that the Rules applicable to SEC RIAs will not currently be extended to exempt-reporting advisers.

III. Bottom-Line Takeaways for Private Fund Manages:

In light of the Rules, we would recommend that all Managers of private Funds, whether or not registered, consider the following:

· Review and potentially reconsider your Fund’s liquidity terms (such as lock-ups, gates, notice periods for withdrawals or early withdrawal penalties) and your ability to waive them because, in the event you waive such terms and you “reasonably expect” that such waiver will have a “material and adverse” effect the fund or other investors, such preferential liquidity term must be extended to all Investors before you offer such term to any Investor. As such, if there is a plausible argument that the grant of a preferred liquidity term could negatively impact a fund, even remotely, we would recommend that such preferred liquidity term be extended

to all investors. In light of the foregoing, some manager may determine to remove the ability to waive liquidity terms altogether;

· Amend and restate your fund’s LPA and PPM if they provide that side letter arrangement need not be disclosed to other investors (Riveles and Wahab’s baseline fund documents contain this language and therefore will generally need to be revised);

· Itemize all prior grants of preferential terms as this information must be provided to all current and prospective investors no later than 12-18 months after passage of the Rules (depending on the registration status of the Manager). For purposes of the required Investor disclosures, consider including information regarding the Manager’s relationship to or the nature of the Investor receiving the preferential terms (e.g. a family member) and/or any preferential terms that were granted based on the size of the Investor’s investment in the Fund (e.g. an institutional investor) to put such preferential terms in perspective and thereby rebut an argument that they should be extended to all investors;

· Rather than having one set of economic terms in your fund documents which are modified under side letters (and now must be disclosed) consider ‘baking’ several classes of economic terms and or liquidity terms into your governing documents for transparency purposes thereby minimizing the need for ongoing disclosures. . Note, however, that as mentioned above, deviating from liquidity terms set forth in the Governing Documents is now prohibited unless the exceptions above are followed;

· With respect to SEC RIAs, establish a consistent framework for providing detailed itemized dollar value reporting of fees, expenses and compensation and fund level performance as required by the Rules on a quarterly basis,

· Since states are likely to adopt the Rules, state-registered RIAs should consider proactively complying with the Rules applicable to SEC RIAs.